- ACCOUNTS PAYABLE DEBIT CREDIT SOFTWARE

- ACCOUNTS PAYABLE DEBIT CREDIT PLUS

This short-term liability due to the suppliers, vendors, and others is called accounts payable.

To elaborate, once an entity orders goods and receives before making the payment for it, it should record a liability in its books of accounts based on the invoice amount. Accounts Payable job qualifications and requirementsĪccounts payable is the amount owed by an entity to its vendors/suppliers for the goods and services received. Accounts payable automation or AP automation is the ongoing effort of many companies to streamline the business process of their accounts payable departments.

Debits increase the balance of dividends, expenses, assets and losses.Ĭredits increase the balance of gains, income, revenues, liabilities, and shareholder equity. ACCOUNTS PAYABLE DEBIT CREDIT SOFTWARE

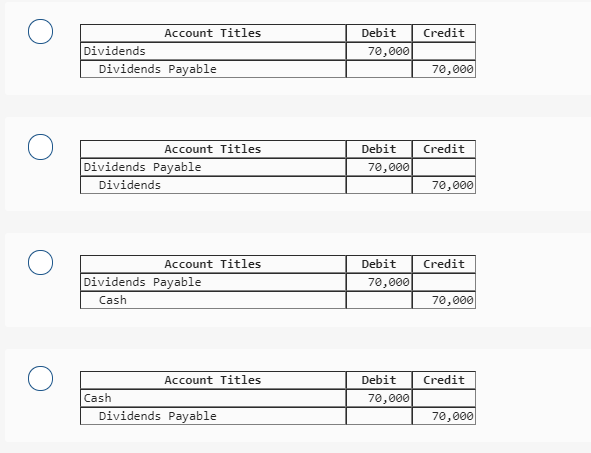

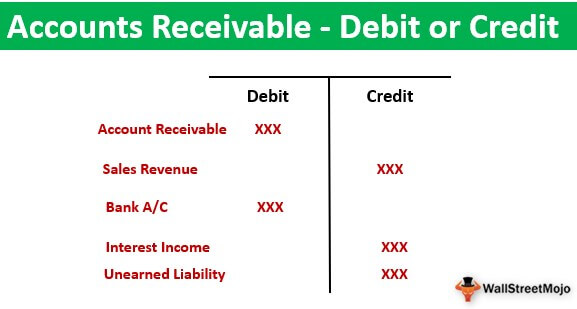

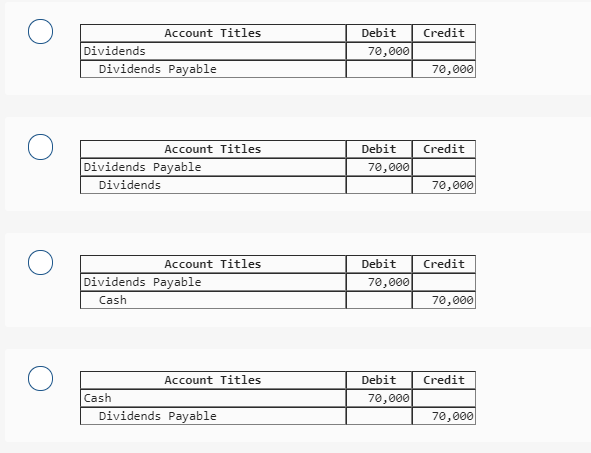

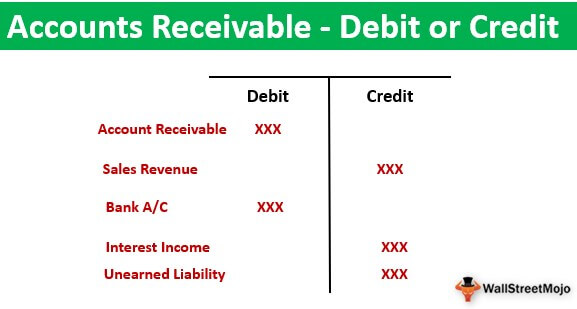

Keep in mind that most business accounting software keeps the chart of accounts flowing the background and you usually look at the main ledger. Because these two are being used at the same time, it is important to understand where each goes in the ledger. Using the car example from Section 1, the liability account, notes payable, would be increased by the amount of the car loan. Credits decrease assets and increase liabilities and owner’s equity. Once the payment is made to the vendor for the unpaid purchases, the corresponding amount is reduced from the accounts payable balance. The equity account defines how much your business is currently worth. Secondly, the buyer credits (increases) a Current liabilities account, Accounts payable.Credits are money coming into the account they increase the balance of gains, income, revenues, liabilities, and shareholder equity. Firstly, the buyer debits (increases) Merchandise Inventory, a Current assets account. The buyer purchases merchandise inventory on credit, which requires two journal entries. As a Current liability, Accounts payable also contributes to these metrics. Debits increase the balance of dividends, expenses, assets and losses.Several other liquidity metrics use the Balance sheet figures for Current Assets and Current Liabilities. Keep in mind that most business accounting software keeps the chart of accounts flowing the background and you usually look at the main ledger. Analysts call APT a liquidity metric because it measures the company’s ability to manage cash flow and meet immediate needs.Because these two are being used at the same time, it is important to understand where each goes in the ledger. Note that APT is a frequency-the number of times per accounting period the company pays off its suppliers. he Accounts payable turnover APT metric uses Income statement and Balance sheet figures to measure the company’s Account payable pay off performance. It is distinct from notes payable liabilities, which are debts created by formal legal instrument documents.In accounting, debits or credits are abbreviated as DR and CR respectively. Automated Accounting Process What is Accounts Payable in simple words?Īccounts payable (AP) is money owed by a business to its suppliers shown as a liability on a company’s balance sheet. Typically, companies practice accrual-based accounting, wherein they add the balance of accounts receivable to total revenue when building the balance sheet, even if the cash hasn’t been collected yet.

Companies looking to increase profits want to increase their receivables by selling their goods or services.

Revenue represents the total income of a company before deducting expenses.

ACCOUNTS PAYABLE DEBIT CREDIT PLUS

Their role is to complete payments and control expenses by receiving payments, plus processing, verifying and reconciling invoices.Revenue is only increased when receivables are converted into cash inflows through the collection. The role of the Accounts Payable involves providing financial, administrative and clerical support to the organisation. The concept of debits and credits may seem foreign, but the average person uses the concept behind the terms on a daily basis. Anything that has a monetary value is recorded as a debit or credit, depending on the transaction taking place. They are the method used to record business transactions, and keep track of assets and liabilities. Debits and credits are an integral part of the accounting system. As a result, the normal credit balance in Accounts Payable is the amount of vendor invoices that have been recorded but have not yet been paid.If the business used cash to make the vehicle loan payment, the asset account cash is decreased. GAAP: Generally Accepted Accounting PrinciplesWhen a company pays a vendor, it will reduce Accounts Payable with a debit amount.

0 kommentar(er)

0 kommentar(er)